It will be practical for companies that are engaged in loans, lending, finance turnover to order the development of an application for a loan. Programs for microfinance organizations will help you conveniently and quickly issue loans to the card, and customers can track the status, repayment history, and interest deductions.

The microfinance market is growing and developing rapidly, the business brings good profits, and buying a program for an MFI will help you control all stages. Also, development is an excellent way to improve the quality of online service.

Program for issuing loans - advantages in Kyiv, Odessa

MFI software is indispensable, a thing for managing and promoting a business. Implementation benefits include:

- All functions in one program. Its development is a complex solution. This is not only a mobile version of the application for users, but also as a type of program for MFIs. The client will be able to get a wide range of functionality: an account, calculators, a loyalty program, etc. Owners will be able to view statistical data, control loans, work with delays. The main task is the automatic issuance of loans. The microcredit service itself is able to analyze the borrower, determine the amount, conditions for a person, based on a complex algorithm;

- Control method. Software for microfinance organizations serves as a CRM engine. The business owner will receive all the data about the actions of customers, the issuance of money, loan repayments, etc. You can integrate everything into one ecosystem with the site. In addition, it is convenient to monitor the actions of managers, create specific access to functions, work algorithms;

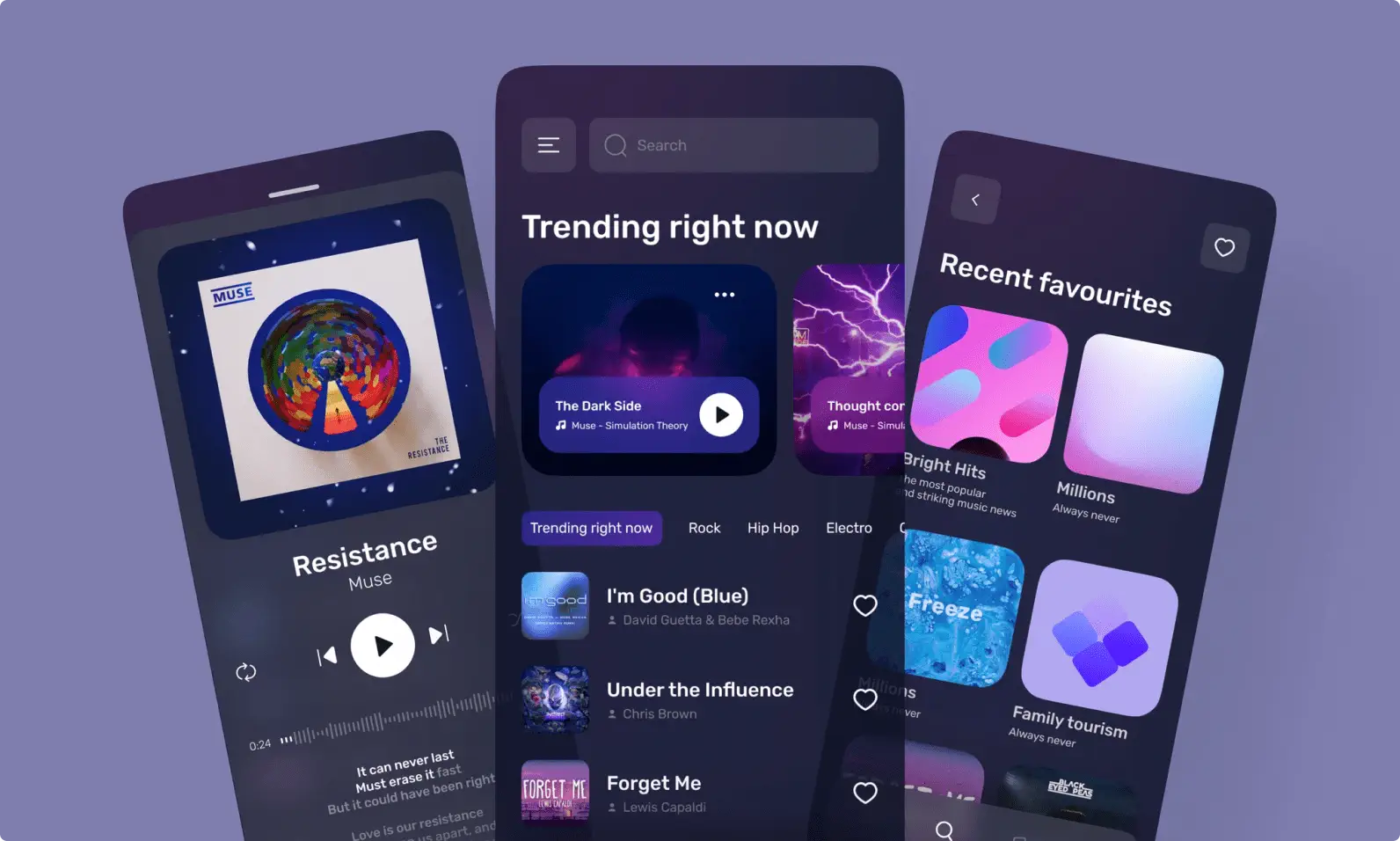

- Fast processing of applications with a thoughtful interface. Online lending has an important advantage - the ability to get a loan in a few clicks in a few minutes. Registration is mandatory, a personal account to track the situation, the client must see how money comes and goes. A good solution is to save all the information, which makes it possible to apply for a loan even faster when you re-apply.

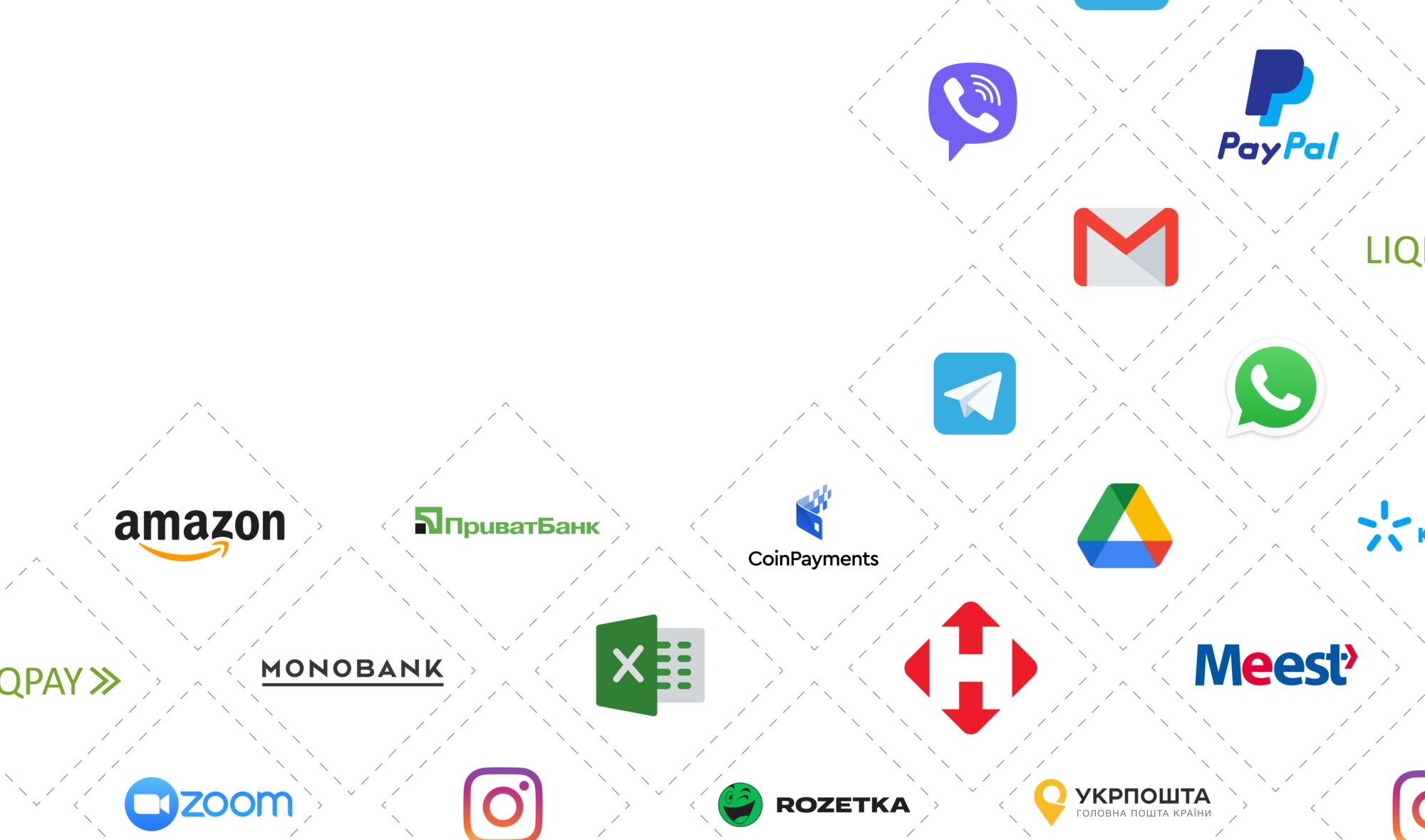

- Interaction with other services. The company can integrate the capabilities of checking the phone number, credit history, payment by card, mailing information, chpts and specialist support.

- Access to analytics. Statistics, interaction analysis can significantly improve the service and business efficiency. You can connect different marketing tools, calculating their result, and see problem areas of using the application. Ukraine has high competition among lending organizations, so you should offer the client the highest quality and comfort;

- High level of security. In order not to enter passwords, codes with SMS, and not to take a lot of time, modern microloan applications are equipped with fingerprint identification, Face ID, etc.

Ocean-agency is a developer company that can create the most convenient financial setting application for both sides of the process. A well-thought-out platform map, data security, control of all stages and fast processing of an application will help to significantly increase turnover and rise to a new level.